Senior Counsel Paul Muite lauds ruling cancelling Sarrai Lease to operate Mumias Sugar Company

By: Rading Biko

Posted on Wednesday, April 20, 2022

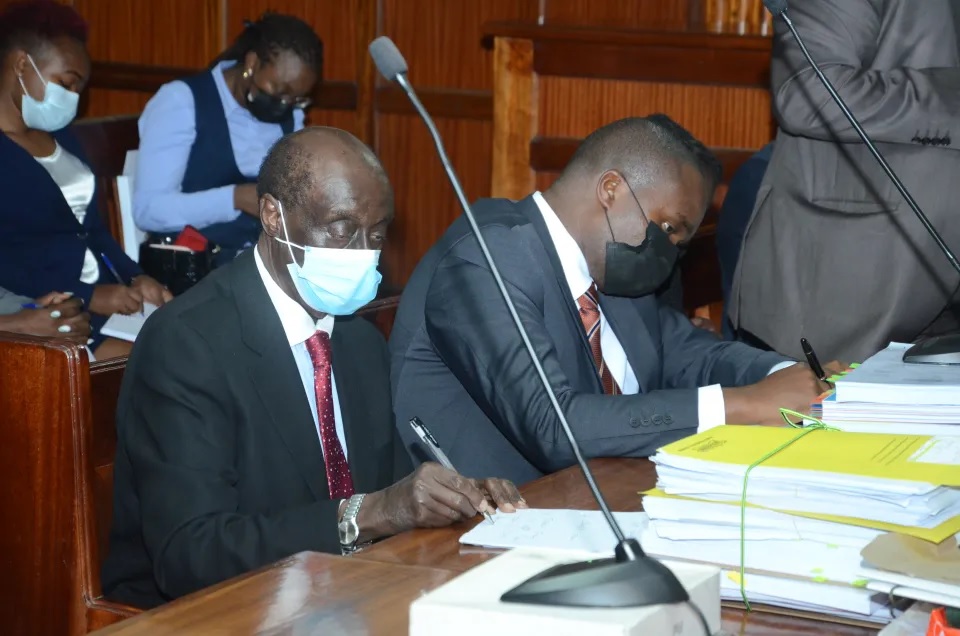

West Kenya Sugar Company lawyer, Mr Paul Muite has lauded the High Court ruling that cancelled the lease granted to Sarrai Group Limited to operate Mumias Sugar Company and removed Mr Ponangipali Venkata Ramana Rao as the Administrator of the company.

Muite said the decision was a big win for farmers, some of whom delivered their sugarcane to the factory a long time ago and had not been paid, adding that Mumias was a major economic anchor for the region.

“There was never any rational basis for awarding the lease to Sarrai who offered Ksh 6billion to revive Mumias when there was West Kenya offering Ksh 36 billion. The new administrator who has been appointed by the judge will ensure that there is transparency and will also ensure Mumias is revived,” the senior counsel said.

In the ruling which was delivered on Thursday last week, the presiding Judge at the Milimani Commercial Court, Justice Alfred Mabeya appointed Mr Kereto Marima as the new administrator of Mumias Sugar Company and ordered Mr Rao to hand over the company to Marima.

“This court has considered the allegations made against the leasing process. Rao awarded the lease to the lowest bidder while there were higher bidders, without giving any justifiable explanation. He explained that his rejection for the bid of Ksh 36 billion was to avoid monopoly, and that bidder (West Kenya Sugar) was a competitor of Mumias Sugar Company, had no financial capability to execute the lease and that it was a spoiler bid,” the judge ruled.

Justice Mabeya said public interest demands that receivership that has yielded zero results takes a back seat and a professional administration of Mumias is given a chance.

The judge said the court expected Rao to act as a professional insolvency practitioner who would undertake his duties strictly under statutory provisions of administration and the competition Act, it did not expect him to undertake the duties of the Competition Authority of Kenya, and there is no evidence to show he sought advice on the same before he made the decision.

The judge also noted there were no other reasons given by Rao to explain why all the other bids that were higher than that of Sarrai Group (Ksh 5.8billion) were disqualified.

“It would have been essential to even have a pre-evaluation of Mumias which would have informed a result price that would have achieved the purpose of paying off Mumias debts and release it from receivership and administration. The manner in which Rao handled the leasing process did not tally with what was expected of him as an administrator. His actions were meant to protect the interests of KCB and if the lease is upheld, the same would be tantamount to blessing KCB with an extra asset known as Mumias for the next 20 years, and of course, would be the greatest miscarriage of justice.”

The judge ruled that the lease was not in line with the best interest of the company, and it is unfortunate Rao did not produce the lease in court and enable it to determine whether it was in the best interest of Mumias as a going concern. “The same was withheld from the court without any explanation. What did it contain that Rao did not want the court to see?” The judge posed.

“A simple calculation would show leasing Mumias at Ksh 5.8billion for 20 years Mumias would perpetually remain under receivership and administration. It would permanently remain an asset under KCB and maybe a retirement home for Rao,” Justice Mabeya said.

While responding to the ruling, Muite added: “I express surprise that KCB, a tier one bank, would have sanctioned this lease at Ksh 6 billion. The CEO and Rao owe the public an explanation as to why they sanctioned the lowest bidder for Mumias. Political leaders also need to explain why they supported Sarrai. These leaders and the county government should have the farmers' interests at heart.”

The lawyer noted that with the newly appointed administrator, the company will be revived and that the interest of the shareholders and the public will be considered.

“This was a well-argued judgment with reasoning. The new appointed administrator will make the decision in a transparent manner,” he said.

Justice Mabeya had pointed out in his ruling that records show the loans of KCB became non-performing in 2017 and KCB never took any action, as it waited until after insolvency proceedings were instituted to wake up from its slumber.

The bank then waited for another six months in September 2019 to appoint Rao as its receiver-manager. After this appointment, receivership continued between the two and according to the receivership accounts filed in court, the receiver had collected more than Ksh 800million between September 2019 and September 2021 when the administration order was made.

Out of the amount, the court observed, none was applied towards repayment of the debts, with Rao stating that there was no surplus for debt repayment. The receivership accounts disclosed that while there were no monies for repayment of the debt, there were monies available to pay donations, facilitation, and PR exercise among others.

“KCB was all happy with that state of affairs and advanced Rao yet another handsome amount of Ksh 200million and continued charging interests for alleged operations. KCB was impressed with the lease which was grossly undervalued and folded its hands to continue sitting on Mumias for another 20 years. All the foregoing is evidence of an uncaring lender who alleges to have been financing Mumias since 1974 and would be happy to continue doing so,” the court ruled.